If you went through a divorce in Massachusetts a decade ago, figuring out alimony was often as simple as following a recipe. You had clear ingredients, straightforward steps, and a predictable result.

But as we move into 2026, that era of clarity is over.

In our latest video, "The Complexity of Alimony in Massachusetts in 2026," we break down exactly how alimony has transformed from a simple math problem into a complex, high-stakes financial balancing act. If you are facing a divorce involving spousal support, understanding these shifts is critical to protecting your financial future.

From Clarity to Confusion: What Happened?

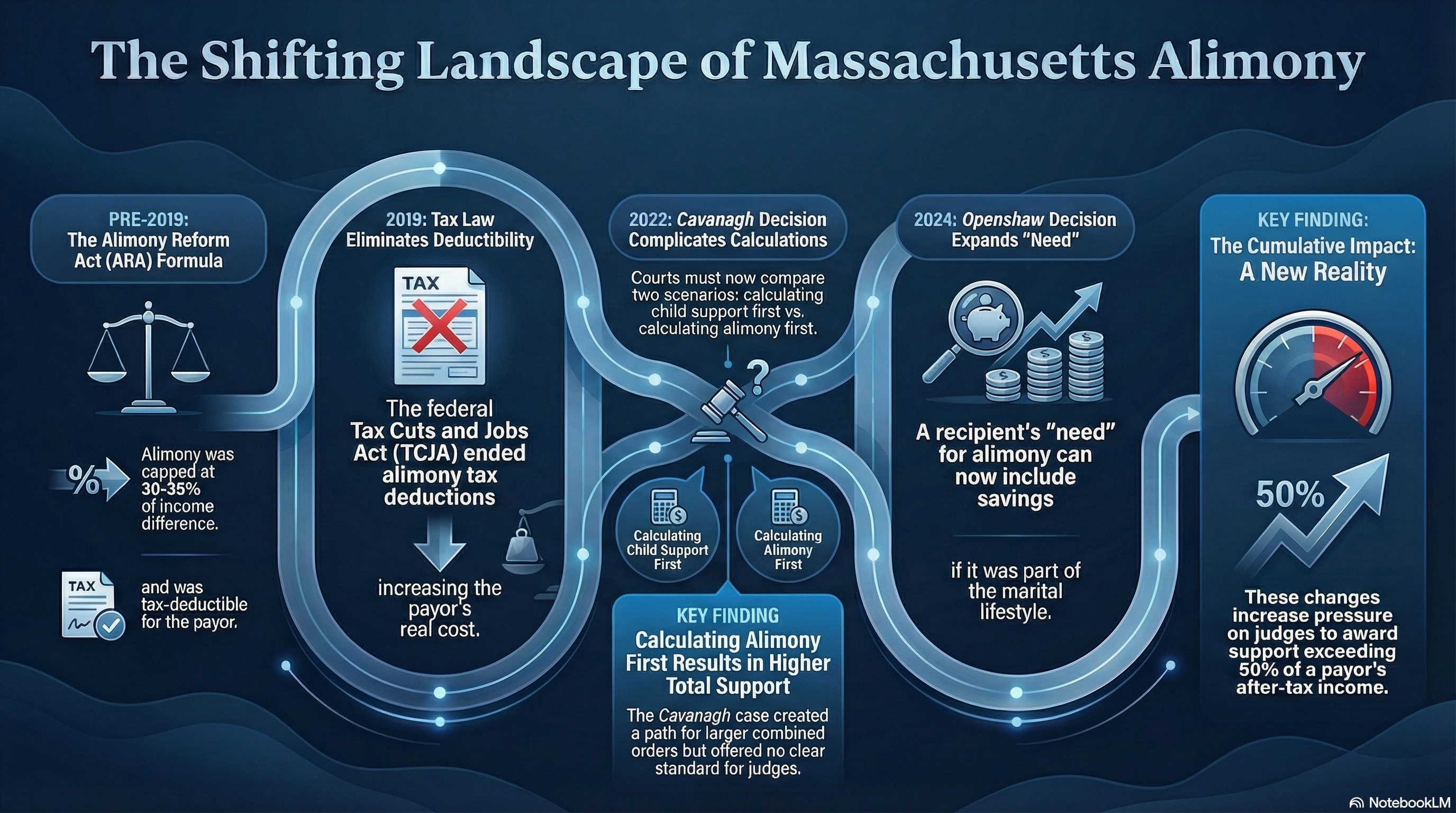

Back in 2011, the Alimony Reform Act (ARA) was passed to take the guesswork out of divorce. It created bright-line rules for how long alimony lasted and set a presumptive cap on payments—generally 30% to 35% of the difference between the parties' incomes.

For years, this formula was the gold standard. However, three major disruptions have dismantled that system, leaving judges with wide discretion and leaving spouses with massive uncertainty.

1. The Tax Deduction Disappeared

The old 30-35% formula was built on a key financial pillar: the assumption that alimony payments were tax-deductible for the payer.

- The Change: The federal Tax Cuts and Jobs Act (and subsequently Massachusetts state law) eliminated this deduction.

- The Impact: Without the tax break, the real cost to the payer skyrocketed. Courts realized the old formula was no longer fair, forcing them to abandon the standard calculations we relied on for years.

2. The Cavanagh "Financial Bake-Off"

With the old formulas gone, the Massachusetts Supreme Judicial Court stepped in. In the landmark Cavanagh v. Cavanagh decision, the court ruled that calculating support is no longer a straight line—it’s a mandatory, multi-step comparison.

- The New Rule: In cases involving both alimony and child support, judges must now run the numbers twice: once calculating alimony first, and again calculating child support first. They then compare the after-tax outcomes of both scenarios to determine what is most "equitable."

3. Openshaw and the "Savings" Factor

Perhaps the most surprising shift came in 2024 with Openshaw v. Openshaw. Historically, "need" was defined by covering your expenses—mortgage, groceries, and cars.

- The Expansion: The court ruled that if a couple had a regular habit of saving money during their marriage, the recipient's ability to continue saving after divorce can now be considered part of their "need." This significantly expanded the definition of income and potential support awards.

The New Reality for 2026

So, where does this leave you? The simple spreadsheet is gone. Today, combined alimony and child support orders can consume 50% or more of a payer’s take-home pay—levels that were unheard of under the old system.

In this new landscape, your financial outcome isn't determined by a calculator; it is determined by the specific facts of your case and the quality of your legal arguments.

How Lynch & Owens Can Help

At Lynch & Owens, we specialize in navigating these complex financial waters. With over 120 years of combined experience, our attorneys understand that predictability has been replaced by judicial discretion. That means you need an aggressive, knowledgeable advocate who can build a strategy tailored to the current laws—not the outdated ones.

Whether you are seeking support or trying to protect your income, do not leave your future up to chance.

Watch the full video above for a detailed breakdown of these changes.

Need expert guidance? Contact us today or call (781) 253-2049 to schedule a consultation with one of our Massachusetts family law attorneys.