Trial Court Department debuts new Massachusetts Child Support Guidelines Worksheet six months after the 2017 Guidelines released.

MAY 18, 2018 - BOSTON – Denise Fitzgerald, Manager of Legal Research Services, was a late addition to the child support panel at the 2018 MCLE Family Law Conference. Fitzgerald made a big splash at the conference anyway, once the program began. Fitzgerald provided attorneys in attendance with a sneak preview of a radically redesigned 2018 Child Support Guidelines worksheet that fixes several glitches in the original 2017 worksheet while dramatically re-organizing a familiar format that had undergone only minor tweaks in the last two decades.

Download and use the amended 2018 Child Support Guidelines Worksheet HERE .

Prior to Fitzgerald’s addition, the MCLE panel was scheduled to focus on three errors in the 2017 Guidelines that had been the focus of extensive coverage in the Massachusetts family law blogosphere. Original panel members Jason V. Owens of Lynch & Owens, Gabriel Cheong of Infinity Law Group, and Justin L. Kelsey of Skylark Law and Mediation – whose blogs’ combined readerships number in the hundreds of thousands per year – had blogged about the 2017 Guidelines glitches extensively, leading to coverage in Massachusetts Lawyers Weekly, and a subsequent promise from the Trial Court to address the issues in October 2017.

Fitzgerald’s release of a 2018 Child Support Guidelines worksheet – which not only fixes the glitches, but reworks the entire calculation form – turned the usually mellow MCLE conference into a source of breaking news. Fitzgerald admitted that fixing the glitches identified by the family law bloggers meant that the new worksheet would result in different child support calculations in many cases, especially those involving a mix of children under 18 and over 18.

In addition to the new worksheet, the Trial Court has posted a “Memo regarding amendments to Child Support Guidelines”, along with an amended version of the Guidelines which have been dubbed the “2018 Child Support Guidelines”.

Trial Court Press Release Explains 2018 Child Support Guidelines Worksheet Release

Midway through the MCLE conference on May 18, 2018, the Trial Court posted a press release explaining the features of the new worksheet:

Trial Court Chief Justice Paula M. Carey today announced the promulgation of amended child support guidelines and guidelines worksheet, which take effect on June 15, 2018. These amendments are a result of a Trial Court review conducted after issues were raised regarding the application of the adjustment factors for children 18 years of age or older, and the adjustment for child care, health care coverage, and dental/vision insurance costs when parents share financial responsibility and parenting time approximately equally.

The press release indicated that along with the new worksheet, a memo from the Court’s economist, Mark Sarro, Ph.D., along with the 2018 Child Support Guidelines, would be available within a week:

The amended guidelines and the fillable worksheet will be posted on mass.gov on May 22nd. A memo from an economic consultant that explains the adjustment factors in detail will also be posted on May 22nd.

2018 Amended Child Support Guidelines Explains the Changes from 2017 Version

Page 3 of the 2018 Child Support Guidelines summarize the changes from the 2017 Guidelines as follows:

In the June 2018 amendments, the Trial Court revised the age adjustment factors in the worksheet to eliminate counterintuitive outcomes in support orders for four or five children, at least one being 18 years of age or older. The Trial Court also redesigned the worksheet so that one worksheet can be used regardless of whether the parenting plan is shared, split, or approximately 2/3 and 1/3. It is no longer necessary to use multiple worksheets to determine the child support amount where there is shared or split parenting plans. The June 2018 amendments do not address the 2018/2019 changes to the federal tax code with regard to alimony and dependency exemptions.

Attorneys and Public Have Until June 15, 2018 to Experiment with New Child Support Worksheet

Unlike the original worksheet, which was released approximately one week before the 2017 Guidelines became law on September 15, 2017, attorneys will have about three weeks to experiment with the 2018 Guidelines worksheet, which will not officially replace the 2017 worksheet until June 15, 2018.

Fitzgerald told the crowd that the 2018 Guidelines worksheet is “final”. However, by providing attorneys and the public a three-week testing period before activating the new worksheet, the Trial Court can avoid a repeat of last September. Last summer, a draft of the 2017 Guidelines was released in July of 2017, but the court’s official worksheet was not finalized until a week before the guidelines became official on September 15, 2017. Within ten days, family law bloggers had already uncovered multiple glitches in the worksheet.

As noted by Friday’s MCLE panelists, the 2018 Guidelines worksheet appears to correct the issues identified by the blogosphere, but the changes mean that child support orders entered over the last six months must be re-examined by attorneys, litigants and court staff. “Some child support calculations are going to be different,” Fitzgerald told the crowd.

New Worksheet Corrects Glitches in the 2017 Child Support Guidelines

At Friday’s conference, Fitzgerald and Child Support Task Force economist Mark Sarro, Ph.D. denied that there were “errors” in the original worksheet. One issue, which generated an incorrect child support calculation when specific numbers were entered in the 2017 form, was characterized by Fitzgerald as a “glitch in the formula” in the original worksheet. Fitzgerald told the crowd the remaining two issues were “not errors” but merely “counterintuitive results”. This was echoed in the press release the Trial Court posted minutes before the panel discussion began:

The June 2018 amendments eliminate counterintuitive outcomes in support orders for four or five children, at least one being 18 years of age or older.

Panel member Gabriel Cheong of Infinity Law Group, expressed skepticism about Fitzgerald’s characterization, referring to the glitches as “errors” and telling the crowd that the original worksheet incorrectly doubled a credit for medical and child care expenses in shared custody cases, while miscalculating child support for cases involving a mix of minor and adult children.

Errors or not, Fitzgerald made clear that all three issues were corrected in the 2018 worksheet. The fixes will result in new child support calculations in two major classes of cases: shared custody cases involving significant medical insurance and child care expenses and cases involving parents with a mix of children under 18 and over 18.

Use and download the Amended 2018 Massachusetts Child Support Guidelines Worksheet effective June 15, 2018 HERE.

New Worksheet Fixes Medical/Child Credits in Shared Custody Cases

Among the big changes in the 2017 Guidelines was an increased financial credit for parents with substantial medical insurance and child care expenses. The 2017 Guidelines provide a more substantial increase in child support for recipient’s paying medical insurance and child care expenses, while providing an additional reduction in payments for child support payers who carry these expenses.

Unfortunately, the 2017 Guidelines miscalculated the credit for medical/child expenses for parents with shared physical custody or split parenting time. In essence, the original worksheet double-counted the medical/child credit, leading to one parent receiving a double credit in shared custody cases.

The 2018 worksheet should fix the double-counting glitch while dramatically streamlining the process in all shared custody cases by performing the child support calculation in a single worksheet, instead of two.

New Child Support Calculations for Parents with Mix of Adult and Minor Children

Another big change under the 2017 Guidelines involved a new approach to calculating child support for adult children (i.e. children over 18). Under Massachusetts law, parents can be ordered to continue paying child support for children as old as 23 years old. However, prior versions of the child support guidelines had taken a “hands-off” approach to child support for adult children, leaving such orders entirely up to individual judges.The 2017 Guidelines took a new approach by establishing a presumptive cap for child support for adult children, which the new Guidelines provided would be 75% of a standard child support order for minor children.

For parents with only minor children or only adult children, the 2017 Guidelines worksheet worked well, steadily increasing child support for families with additional children. The same was not true for parents with a mix of adult and minor children, however. For these families, more children did not equate to increased child support; indeed, the worksheet actually reduced child support for parents with four or five children.

The 2018 worksheet corrects this issue by weighing the increase in child support for adult children at exactly 75% of the increase for minor children. Under the new worksheet, parents will receive full child support for their minor children, while receiving a more modest increase (i.e. 75%) for additional adult children.

The state’s press release described the adjustment under the new worksheet as follows:

The June 2018 amendments eliminate counterintuitive outcomes in support orders for four or five children, at least one being 18 years of age or older. The age adjustments in the September 2017 Table B were based on applying the 25 percent discount listed in the guidelines in equal proportion to the number of children 18 years of age or older. The age adjustment percentages in the June 2018 Table C are based on applying the 25 percent discount to the oldest children last. That is, the 25 percent discount is applied only to the increases in child support for additional children, rather than to the overall amount of support. Children 18 years of age or older are accounted for last in this calculation to fully preserve the increases in child support for additional younger children. Because of the change in the application of the adjustment, some child support orders will increase if there is at least one child 18 years of age or older.

The state’s press release may undersell how the sweeping the amended 2018 worksheet’s changes will be for families with a mix of adult and minor children. Indeed, Fitzgerald confirmed that the new worksheet will result in a different child support calculation for every case involving a mix of minor and adult children compared to the 2017 worksheet. Parents, attorneys and court staff should be especially diligent about recalculating child support using the new worksheet in such cases.

Major Design Change: Single Child Support Worksheet for Shared Custody Cases

As we have covered in our blog, Massachusetts has so far declined to follow a growing national trend towards making shared physical custody presumptive in cases involving minor children. However, shared custody arrangements are unquestionably on the rise in Massachusetts, as more women enter the workplace and dual-income households are increasingly the norm among married parents.

The newly announced 2018 child support guidelines worksheet will make calculating child support in shared custody (also known as split parenting) cases much easier. Instead of being required to prepare two worksheets – with each parent as both parent and recipient on alternating sheets – the new worksheet will perform the shared custody child support calculation on a single worksheet. The 2018 Child Support Guidelines removes the language requiring parties to submit two Guidelines worksheets to the Court in shared custody cases.

The requirement of using two worksheets for every shared custody calculation was particularly difficult in cases in which attorneys or parties needed to present multiple hypothetical child support scenarios to judges. Instead of receiving two or three worksheets from each party, judges found themselves receiving up to twelve worksheets that needed to be organized and analyzed. The shift to a single worksheet will be a welcome change in split parenting cases.

A (Very) New Look with the Revised 2017 Child Support Guidelines Worksheet

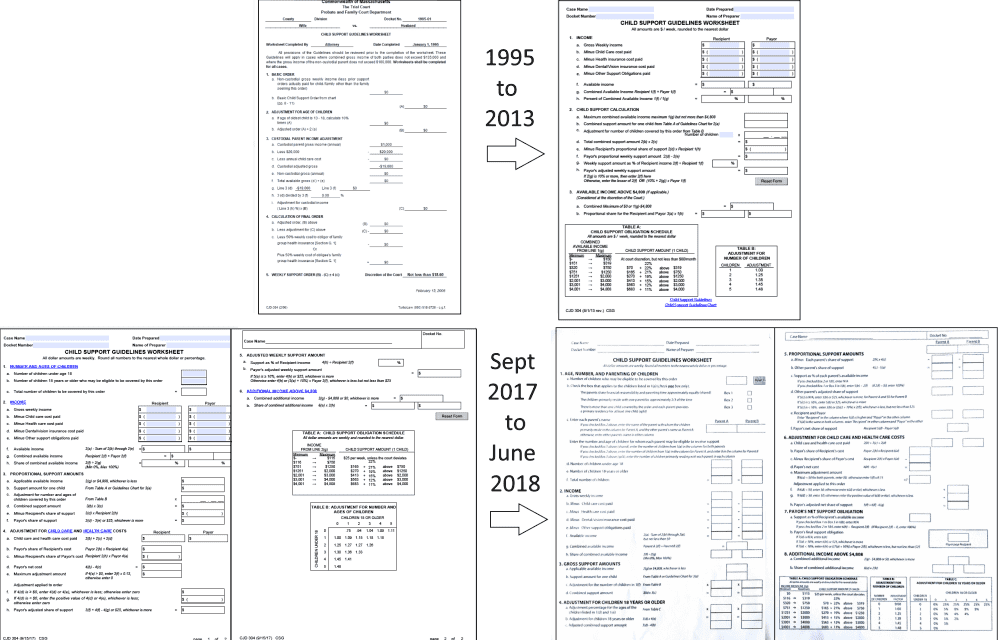

The image below shows the evolution of the Massachusetts Child Support Guidelines from 1995 through the 2018 worksheet, which becomes effective on June 15, 2018:

From 1995 to 2013, the Guidelines worksheet underwent very little change. In September 2017, the worksheet suddenly grew to two pages. The extra page was needed for the new calculations required for the increased medical/child credit. Even with the extra page, the September 2017 worksheet was quite similar to the 2013 Guidelines worksheet, which was largely unchanged from the 1995 version.

The 2018 worksheet provides a radically different look and feel compared to prior Guidelines worksheets. The boxes and terminology have changed in the new worksheet. The methodology in the new worksheet is elegant, but…different. Probate Court regulars should expect a bumpy transition over the next several months, as two decades of habits are broken with the Trial Court’s adoption of the 2018 Guidelines worksheet.

The 2018 worksheet appears to include logical solutions for the additional tasks the Guidelines must now carry out, including the medical/child credit and the 75% child support calculation for children over 18. However, the added complexity poses its own problems, as an ever-increasing number of litigants in Massachusetts Probate and Family Courts are self-represented individuals. The truth is, many attorneys struggle with the math required by the 2017 Guidelines. However, attorneys know where to find online calculators and other resources for performing the needed calculations. Individuals without attorneys are likely to find the new worksheet more challenging than those released previously.

Questions for 2021: Does the Child Support Guidelines Worksheet Need to be Simplified?

When the first draft of the 2017 Guidelines was released in the summer of 2017, we reviewed the big changes under the new Guidelines approvingly. The increased credit for medical/child expenses addressed a specific and pressing problem. The 25% decrease in child support for adult children also addressed a long-time ambiguity under the law that the state’s appellate courts had never clearly tackled. Of course, there is a price to be paid for each of these changes in the form of increased complexity.

Use and download the Amended 2018 Massachusetts Child Support Guidelines Worksheet effective June 15, 2018 HERE.

Interestingly, another change under the 2017 Guidelines – which eliminated “hybrid” child support orders for parents with 34 to 49% of the parenting time – actually reduced the complexity of the child support picture in Massachusetts. What this change did not do, however, is shorten the length of the child support Guidelines worksheet. Instead, the 2017 worksheet grew to two pages. The 2018 worksheet also includes two pages.

Over the next two years, the new Probate and Family Court Chief, Hon. John D. Casey must begin assembling a new Massachusetts Child Support Guidelines Task Force, with an eye towards the 2021 Guidelines. Among the policy considerations, the new Task Force must debate is the simple question of whether the Guidelines Worksheet should be simplified, even if it means eliminating some of the useful tools that were unveiled in the 2017 Guidelines and carried forward to the 2018 Guidelines.

One potential simplification could involve only applying the 25% decrease for children over 18 to cases in which all children have reached adult status. Much of the complexity under the current worksheet involves calculating child support for families with a mix of children under 18 and over 18. If the 25% decrease only kicked in after all children reach 18, the math would become far simpler under the Guidelines.

Similarly, it may be possible to achieve a somewhat generous credit for medical insurance and/or child care costs without the multiple calculations used in the current worksheet. Simplifying the calculation would reduce precision and fairness, but the Task Force must consider the cost of precision in the form of increased complexity.

There is no right or wrong answer to the question of complexity. All of us want child support guidelines that are fair, flexible and responsive to economic trends such as rising medical insurance, child care and college costs. At the same time, all of us want child support guidelines that are intuitive and simple enough for most unrepresented parents to understand. The tension between simple rules - which everyone can follow – and a more complex systems that creates more fair and nuanced outcomes is one that is playing out across society as we increasingly rely on computer-generated algorithms to decide complex societal problems.

About the Author: Jason V. Owens is a Massachusetts divorce lawyer and Massachusetts family law attorney for Lynch & Owens, located in Hingham, Massachusetts and East Sandwich, Massachusetts.

Schedule a consultation with Jason V. Owens today at (781) 253-2049 or send him an email.